Report by Sonia Trubia and Robert Dennis

“E-talia” bucks the downward trend

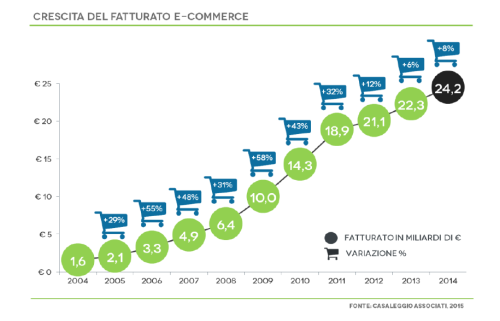

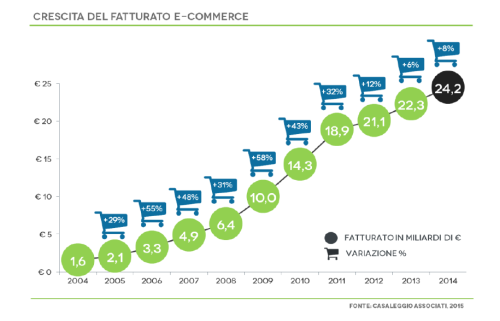

At their annual “E-commerce in Italia” conference, held earlier this year at the Milan Chamber of Commerce, Casaleggio Associati, presented their regular snapshot of the state of the mouse-driven marketplace in Italy (pdf available here, in Italian). It certainly makes for interesting reading; despite the continuing economic crisis and generally disappointing growth in the economy, e-commerce in the Bel Paese is growing, with the market for online sales in 2014 showing an 8% rise on the previous year. However, when set against the bigger picture of the global e-commerce market, with growth worldwide expected to reach just over 20% this year, it is clear that there is still room for improvement.

The fact remains that online shoppers play an increasingly significant role in the Italian economy (with total turnover for e-commerce worth just over 24bn euros last year) and this is being driven progressively by mobile, which now accounts for 13% of online sales (up from only 5% three years ago).

The two online behemoths, eBay and Amazon, with their vast and ever-expanding range of products to tempt the consumer, their competitive pricing and above all their reputation for reliability – essential for wary purchasers flexing their plastic or using online payment services such as PayPal – continue to dominate the Italian e-commerce market. (63% of Italian online shoppers use Amazon while 57% of customers use eBay.) Despite their relatively much smaller presence, other players, such as the French Pixmania (PixPlace) and Buy-me.it (part of the Mail Boxes Etc. group) are making themselves felt. Additionally, China-based Alibaba and Etsy (which focuses on handmade and vintage items) are gaining a toe-hold.

We called while you were out…

Overall then, the proportion of consumers using e-commerce in Italy is up and the trend is set to continue. But making purchases online is actually only half the story. The really tricky part is getting those products into the hands of the consumer after they have pored over the screen selecting from all the desirable goods on offer and clicked on the final “PAY NOW” button. Completing orders and delivering the merchandise should be straightforward, but this is often where the real frustration begins – both for the vendor as well as the consumer. Most couriers, for example, only deliver parcels during working hours, which, obviously, is inconvenient for most people, especially workers who won’t be at home to take the delivery. If no one picks up the parcels after several visits, then the courier the has to return it to the closest post-office or the delivery centre where it was dispatched from – and the hapless online buyer will have to go and pick it up themselves.

What’s Indabox?

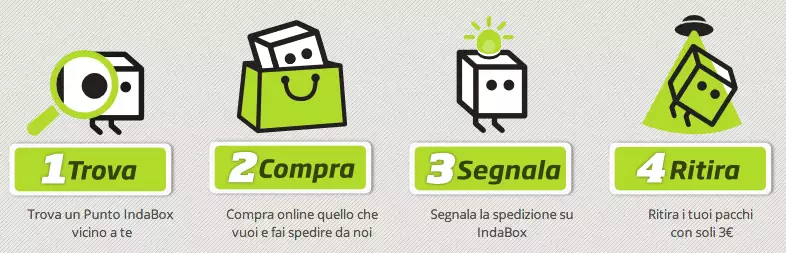

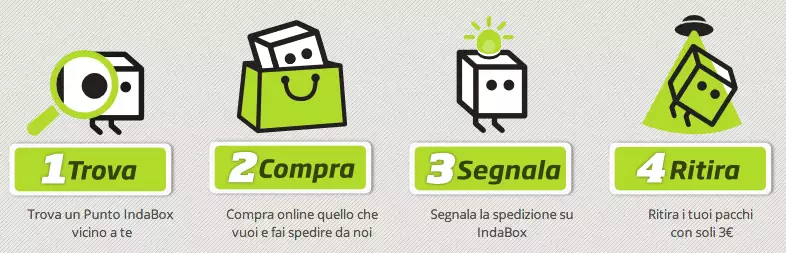

This was exactly the dilemma that two friends from Turin, Giovanni Riviera and Michele Calvo, wrestled with – and came up with a uniquely Italian solution to the problem. At the end of 2014, they launched an app called Indabox, which allows users to look for a convenient delivery spot in their area and have the parcel delivered there, without having to worry about anything else. Indabox now has a steadily expanding network comprising more than 2400 drop-off points, including bars, supermarkets (they are in a partnership with Carrefour) and tobacconists. These business were chosen as drop-off spots because they can be found throughout the country, thus giving users a much greater chance to find a convenient place to have their purchases delivered. Bars are the most popular option, because, unlike other shops or supermarkets, they often close at 10pm, if not later. RelaisColis, the French equivalent of Indabox, is a very successful enterprise, and has a huge network of drop-off and pick-up points (over 4000).

This was exactly the dilemma that two friends from Turin, Giovanni Riviera and Michele Calvo, wrestled with – and came up with a uniquely Italian solution to the problem. At the end of 2014, they launched an app called Indabox, which allows users to look for a convenient delivery spot in their area and have the parcel delivered there, without having to worry about anything else. Indabox now has a steadily expanding network comprising more than 2400 drop-off points, including bars, supermarkets (they are in a partnership with Carrefour) and tobacconists. These business were chosen as drop-off spots because they can be found throughout the country, thus giving users a much greater chance to find a convenient place to have their purchases delivered. Bars are the most popular option, because, unlike other shops or supermarkets, they often close at 10pm, if not later. RelaisColis, the French equivalent of Indabox, is a very successful enterprise, and has a huge network of drop-off and pick-up points (over 4000).

The service offered by Indabox is also affordable. The first Indabox pick-up is free, but from the second time onwards you have to pay a €3 fee (€1,50 goes to the business and €1,50 to the startup itself) each time you pick up your parcel. It’s a price users are willing to pay for the added convenience.

Of course, Indabox is not the only option e-commerce customers have. A less personal alternative is that of using a “locker”, similar to the luggage lockers that used to be a feature of every central station and airport. In Italy, the most active network of lockers is operated by Inpost. Inpost is a “click-and-collect” service allowing online buyers to have deliveries made at specific locations with automated lockers, where they can collect them 24/7. However, while in other countries the locker system works very well, in Italy it hasn’t proved that popular or practical. Inpost, for example, only works with one courier and its network is not as extensive as that of Indabox.

Moreover, Indabox and RelaisColis have a twofold advantage over other apps such as Inpost. On the one hand, they have an interesting social angle, which is not only a key component in disruptive technology startups but also a critical factor in this highly socialized country. Popping in to your local bar to pick up a package naturally enough leads to personal contact, however short or shallow, with shopkeepers, bartenders and other customers. But most importantly for the drop-off points themselves, they can have a knock-on effect in terms of sales. As one of the Indabox founders recently told Wired Italy: “Maybe someone decides to pick up their parcel, which was dropped off at a bar, during their lunch break, and then perhaps they decide to eat a sandwich there or to have a coffee, hence boosting the bartender’s turnover and making a contribution to the domestic market.”

Thanks to startups like Indabox, gaps in the online shopping experience are being filled and the whole process of buying and receiving goods is becoming that much more comfortable and convenient – it certainly avoids the need of staying at home in case you miss the courier or making an unnecessary to pick up your products from an out-of-the way warehouse or post office. And if collecting your online deliveries is also an excuse to enjoy a drink and chat, then so much the better. (Indabox even has an “IndaCoffee Card” which allows you to get every fifth coffee free from participating bars in the network.)

(c) Milan Business English Network, 2015

About the authors:

Sonia Trubia is a freelance writer and translator based in Genoa. She speaks Italain, French and English and is currently completing an MA about the British novelist A.S.Byatt.

Robert Dennis is the founder of the Milan Business English Network and Director of Riverstone Language & Communications, which provides English language training and translations.

Share and Enjoy